The application is available on Google Play for Android devices and the Apple App Store for iOS devices. You can download it from the links below:

Download Allianz Bank Bulgaria SmartID for Android

Download Allianz Bank Bulgaria SmartID for iOS

Download Allianz Bank Bulgaria Smart ID for "Huawei mobile services“ (without Google activities)

During the installation process, you will need to give the necessary permissions to the mobile application to access the system functionalities of your mobile device. An Internet connection is required to use the Allianz Bank Bulgaria SmartID application. The minimum required versions of the operating systems are iOS 10 and Android 6.

Registration for customers with active banking Allianz E-Bank, with a registered token

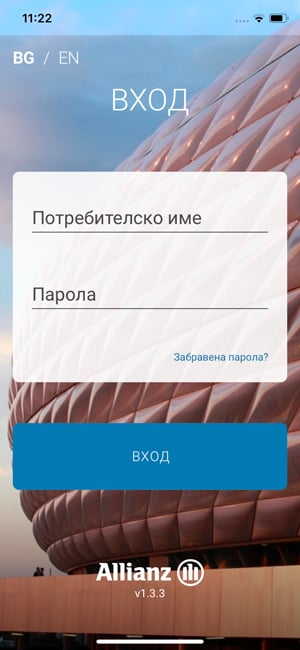

1. At the first step in the mobile application, enter your username and password for the Internet banking;

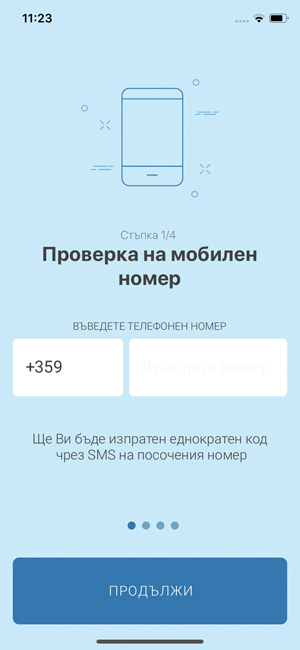

2. At the second step, you need to enter the mobile phone number you have provided to the bank. You will receive an SMS with a one-time activation code on this number;

3. At the third step, you should enter the one-time activation code received via SMS which is valid for 5 minutes;

4. At the fourth step, you need to enter the PIN code of your token, as well as the six-digit code generated by it;

If the information is correct, the application transfers you to step number five where you should set a PIN code that you will use in the future in the mobile application;

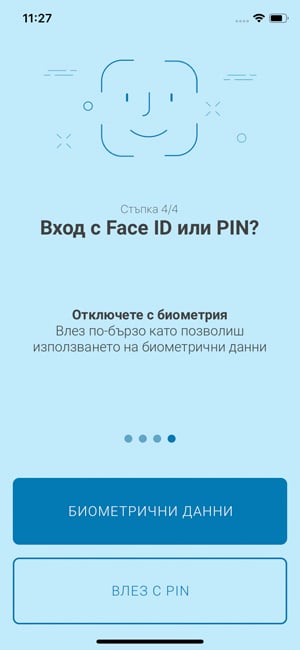

5. At the last step of the registration process, you can choose a way to log in to the mobile application – with PIN or biometric data, as long as your device has a fingerprint reader. You can change the way you log in to the application at any time from the Settings menu.

Registration of customers with passive banking Allianz E-Bank, without a registered token

1. At the first step in the mobile application, enter your username and password for the Internet banking;

2. At the second step, you need to enter the mobile phone number you have provided to the bank. You will receive an SMS with a one-time activation code on this number;

3. At the third step, you should enter the one-time activation code received via SMS which is valid for 5 minutes;

4. At the fourth step, you should set a login PIN code which you will use in the future in the mobile application;

5. At the last step of the registration process, you can choose a way to log in to the mobile application – with PIN or biometric data, as long as your device has a fingerprint reader. You can change the way you log in to the application at any time from the Settings menu.

1. Receiving a push notification with an identification request

The cases in which the Internet and mobile banking system sends an identification request to the Allianz Bank Bulgaria SmartID mobile application are the following:

- Login to the Internet and mobile banking;

- Signing of a payment transaction and / or a package of documents – mass payment;

- Signing a declaration under the Anti-Money Laundering Act;

- Opening of a deposit or online savings account;

- Cancellation of payment transactions in the Pending Approval menu;

- Login to the Internet and mobile banking platform;

- Signing of a payment order or a document ordered through the Internet and mobile banking platform.

Note: All other documents are signed in the same way as a standard payment transaction. Internet banking sends the request to the mobile application, you open the notification, then confirm or reject the request.

2. Confirmation of online card payment and card blocking / unblocking

3. Settings in Allianz Bank Bulgaria SmartID

Allianz Bank Bulgaria recommends users of the mobile application whose smart devices support the possibility of identification in the device via biometric data to request login to the application by fingerprint or facial recognition instead of PIN.

See the demo videos with instructions for registration

Steps for registration

Do you need help?

Find documents relevant for you